What it Means to be a Director of a Public Charity

By: Donna Buzby, CPA

What is a 501©(3) Organization?

Being a 501(c)(3) organization means that the organization has been approved by the Internal Revenue Service as a tax-exempt, charitable organization. The IRS includes a number of organizational purposes as being “charitable.” These are:

- Religious

- Educational

- Charitable

- Scientific

- Literary

- Testing for public safety

- Fostering of national or international amateur sports

- Prevention of cruelty to animals and children

501(c)(3), Exempt and Nonprofit

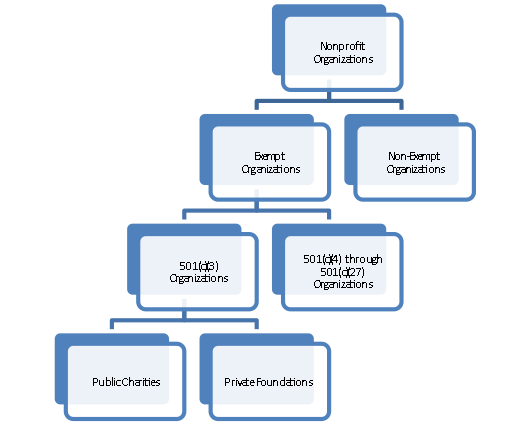

Many people use the terms 501(c)(3), exempt, and nonprofit interchangeably, but that is not actually correct. Nonprofit means that the organization has incorporated or officially formed under nonprofit statutes for nonprofit purposes. 501(c)(3) means a nonprofit organization has been recognized by the IRS as being tax-exempt under Section 501(c)(3) of the Internal Revenue Code, which allows individuals who contribute to receive a charitable contribution tax deduction. Exempt means that the organization qualifies to be exempt from income taxation under either 501(c)(3) or under other sections of the Internal Revenue Code listed in Sections 501(c)(4) through 501(c)(27). These sections do not allow individuals who contribute to them to receive a charitable contribution tax deduction.

The hierarchy looks something like this:

Advantages

Obtaining 501(c)(3) exempt status benefits organizations because their charitable activities are exempt from income tax to the organization, and benefits individuals because their charitable contributions may be deducted as itemized deductions on their individual income tax returns. In addition, the organization can use less expensive nonprofit postal rates, and are eligible to apply for grants from private foundations. Some states also exempt these organizations from state income taxes, sales taxes, and/or property taxes.

Prohibited Activities

501(c)(3) organizations cannot engage in the following activities:

- Conducting significant lobbying

- Engaging in any political activity

- Having significant business income unrelated to the exempt purpose

- Engaging in activities that substantially benefit the private interest of an individual or organization

- Allowing income or assets to inure to the benefit of insiders

Requirements

501(c)(3) organizations must demonstrate that they

- Have organizational documents that restrict their activities to charitable activities

- Have organizational documents that require them to convey all their assets to another 501(c)(3) upon termination

- Operate their activities to support their charitable purpose

- Maintain adequate records to comply with requirements

- File all required IRS tax and information returns

- Provide certain information to anyone who asks

In addition public charities must further demonstrate

- Broad public financial support

- Board of Directors made up of mostly unrelated individuals

Becoming a 501(c)(3) Organization

The organization must file an application with the IRS and pay an application fee. Once the IRS determines that the organization meets all the requirements, it formally documents its approval in a determination letter.

Board Responsibilities

As a Director of a nonprofit organization the Board has several key responsibilities.

- Set mission and policies

- Ensure adequate planning

- Monitor performance and results

- Ensure ethical integrity

- Choose and evaluate the CEO

- Fundraising

Setting Mission and Policies

One of the prime responsibilities of the Board is to set the organization’s mission and the policies in place for governance, programming, and asset protection. Policies such as the following may be among those considered:

Personnel policies

| 990 review policy | Check signature policy | Code of ethics |

| Conflict of interest | Emergency management | Employee travel policy |

| Endowment spending policy | Executive compensation | Expense reimbursement |

| Fundraising policy | Gift acceptance policy | Investment policy |

| Open records policy | Privacy policy | Whistleblower policy |

| Public inspection policy | Record destruction | Record retention |

| Risk management policy | Social media policy | Volunteer policy |

Ensure Adequate Planning

Planning is necessary for the success of any organization and the nonprofit world is no exception The Board should plan not only for annual or ad hoc purposes, but also for long-term strategic purposes. A Director should be engaged in the planning process by asking good questions, expecting good answers, and serving as a resource in areas of personal or professional expertise.

Planning may consist of processes such as

- Financial plan and annual budget

- Evaluation or re-evaluation of mission

- Current and potential new programs

- Fundraising strategies

- Development of membership, leadership and staff

Monitor Performance and Results

Monitoring is a key activity to protect the organization’s assets and maintain accountability over public funds as well as keep staff focused on primary short and long-term goals.

The Board should track monthly financial results against the budget as well as review and approve the annual tax returns and financial statements. In addition there should be programmatic or service performance data tracked against expectations and goals.

Just as it is necessary in planning processes, each Director should expect to think about the information provided, ask good questions and get good answers.

Ensure Ethical Integrity

The ethical tone of organization leaders has an immense effect on the ethical conduct of staff and other partners. Organizations with high standards and values inspire higher standards and are more likely to have less waste and abuse than organizations with less focused leadership.

Choose and Evaluate the CEO

The relationship between the Board and the CEO is of critical importance. The CEO is charged with conducting and overseeing the day-to-day activities of the organization and its programs. The Board chooses the CEO, evaluates CEO performance,, sets CEO compensation, and acts as the CEO’s trusted advisor.

The amount of compensation of the CEO and other key employees is an issue of interest not only to the general public but also to the IRS. If someone is paid more than the value of his services it is considered an “excess benefit transaction.” In order to protect the organization, the Board must do the following:

- Formally approve the compensation in advance

- Base the compensation on specific research about what someone would earn in a similar position at an organization of the same size with a similar mission

- Document all the factors involved in the decision at the time the decision is made. There are very specific elements of the decision that must be documented.

An excess benefit transaction that is not repaid is subject to substantial fines, including fines on the organization, the recipient and individual Board members.

Fundraising

Having adequate funding is necessary for any organization to thrive. Organizations that rely on fundraising to support their programs often need Board members to assist in developing events, network with the right charitable donors and donate their own funds.

In Summary

Being a Director of a nonprofit public charity comes with a big dose of responsibility. Directors’ names are linked with the organization in the eyes of the public via sites like Guidestar and Charity Watch. Also the annual tax returns, list each Board member that served during the year.

Directors need to remain actively engaged and vital in their role of advisory oversight to ensure a productive and vital organization. For those willing to make this commitment however, service on the Board can be a rewarding way to give back to their community.